- Navigator

- Industry Analytics

- Real Estate

- National

- Retail, Services & Accommodations

In this two-part article about the current state of retail, we take a look at the growth of ecommerce, take-out and to-go services, omni-channel marketing, and sub-leasing within the sector. In February, we’ll look at trends indicating a return to normalcy and changes in retail real estate needs resulting from the pandemic.

Into the Ether

Consumers continue to evolve. The model of shopping that begins and ends with a single trip to a local store is gone. Retailers must meet buyers where they are and that has implications for how they do business, where they set up shop and how a storefront looks—if there even is a storefront.

For many products, shopping now starts with online research—checking out features, pricing, user reviews, and availability. Increasingly, this is where the transaction culminates, too—with the click of a “Buy Now” button.

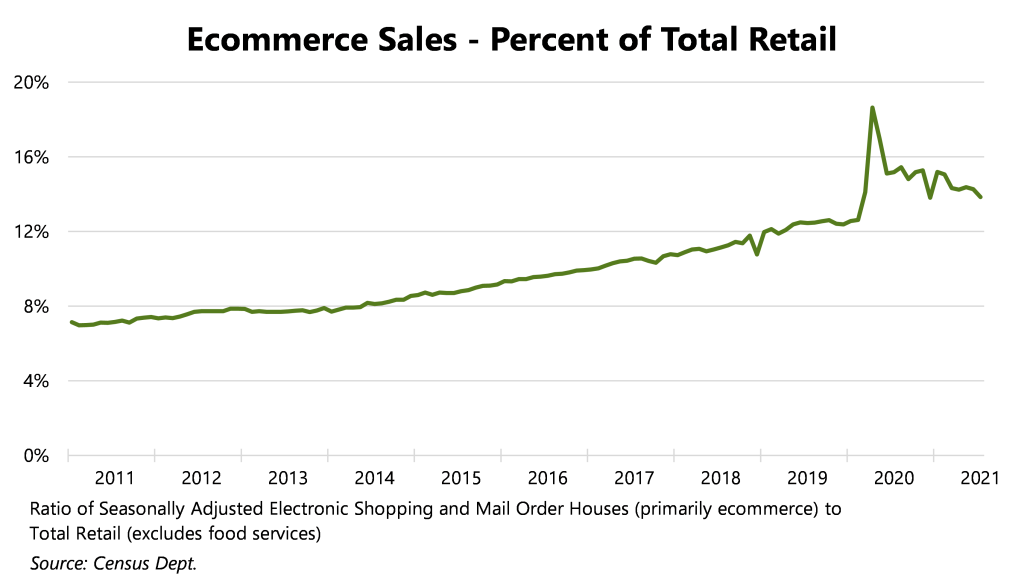

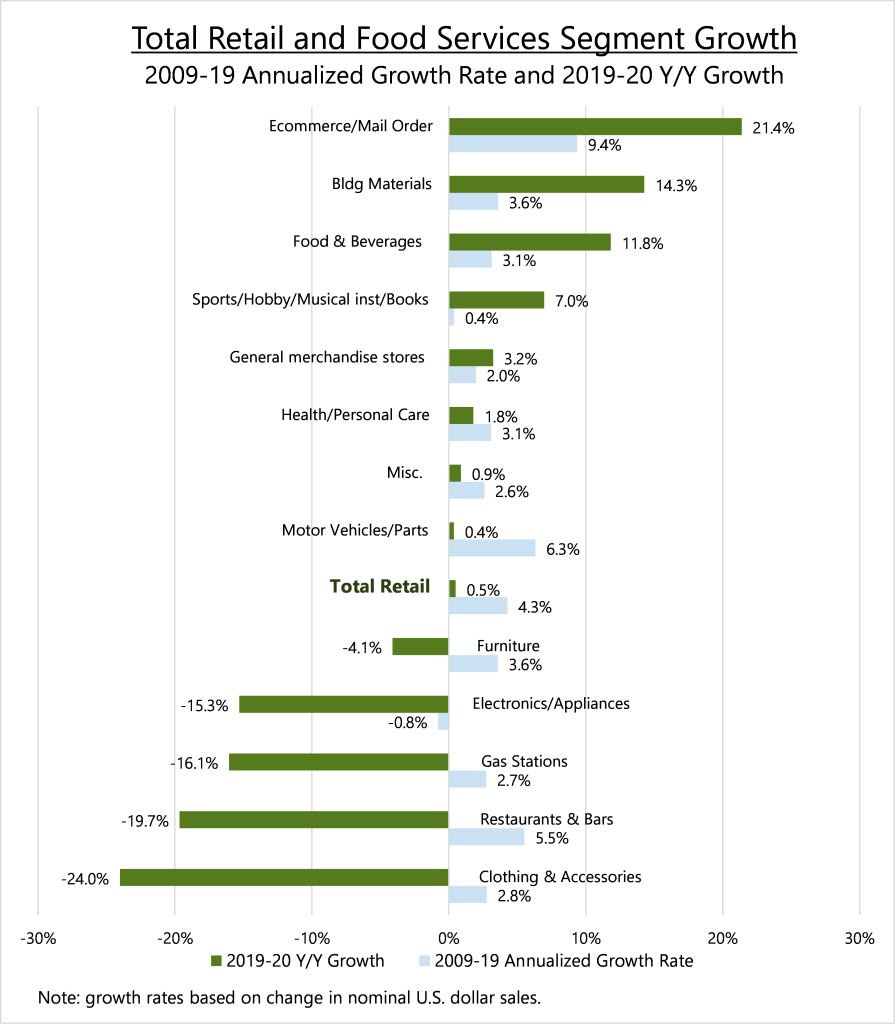

Since the mid- to late-1990s, when Amazon and PayPal first launched, ecommerce has ramped up steadily, growing by 11.7% per year (1995-2020). This overall shift then saw a strong boost in 2020 due to COVID-19, when non-store retail (primarily ecommerce) surged by 21.4% and its share of total retail sales jumped from 12.3% in 2019 to 14.9% in 2020. That percentage appeared to be settling back in the first half of 2021, as pandemic restrictions eased and consumers made their way increasingly back to brick and mortar retailers.

Going forward, however, the prospects for ecommerce remain strong as retailers continue to leverage technology to drive sales growth. Big data, AI and chat-bots combine to provide a more personalized shopping experience, while mobile apps, voice search and subscription services make the process faster and easier.

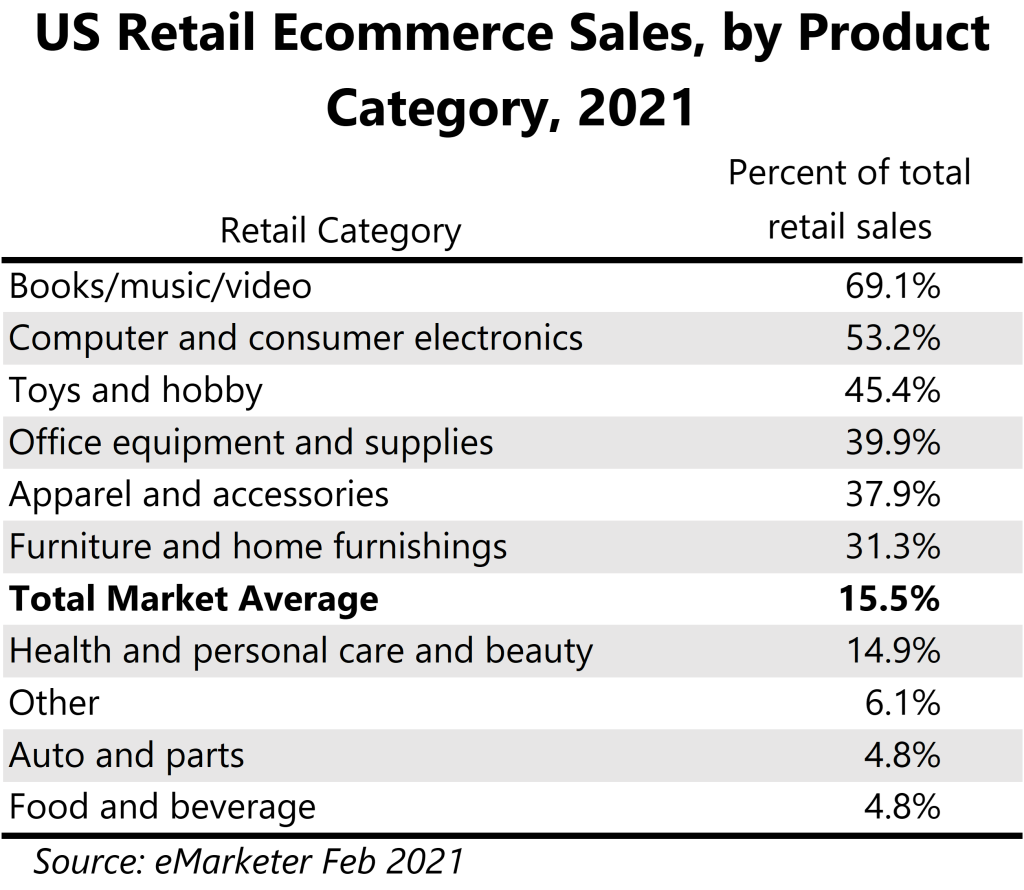

This shift in consumer purchasing has not hit all retailers evenly, however. For certain products that lend themselves to online shopping, such as books and other media, nearly two thirds of sales are now made via the internet, according to eMarketer. For computers and other electronics gear, over half of sales go through this channel.

Same as Before—Only More So

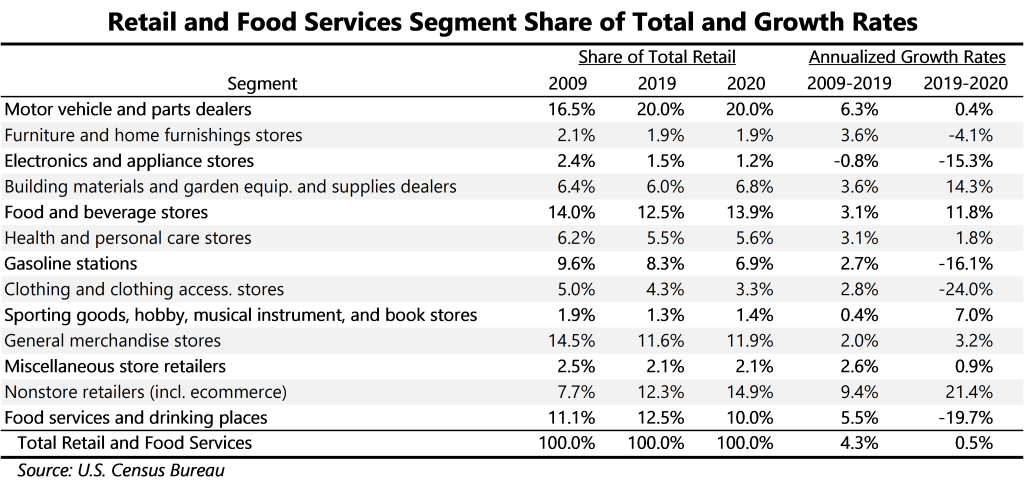

In large part, the pandemic accelerated general trends already playing out in the marketplace. Electronics and appliances stores have suffered declining sales since 2012, with a growth rate of -0.8% per year from 2009 to 2019. These retailers took a major hit in 2020 when sales then shrank a further 15.3%. The upshot was that this segment pulled in only half the share of retail and food services spending that it did just ten years ago, falling from 2.4% in 2009 to 1.2% in 2020.

A similar story holds for clothing stores. Limping along with sales growing at a modest 2.8% per year over the 2009 to 2019 period, this sector slipped from 5% of total retail sales down to 4.3%. When the pandemic kept people home from work and other social settings, however, the need for a new wardrobe disappeared. Clothing sales plummeted by nearly a quarter in 2020 (down 24%) and consumers’ proportion of retail spending with these merchants slid to just 3.3%.

A sharp double-digit decline also hit restaurants and bars in 2020 as pandemic lockdowns kept people from eating out. Many eating establishments quickly pivoted to providing take-out services, which stemmed the overall decline to only 19.7%. Having enjoyed above-average growth over the prior decade, however, this recent sharp drop in sales will likely reverse quickly and is not likely related to any secular long-term trend.

Of course, not all retail segments felt the pinch. With plenty of time on their hands, many people found themselves all dressed down and no place to go. For those whose income stream was not disrupted by stay-at-home orders, the time was right for DIY home repairs, outfitting the home gym, and taking up the ukulele. Sales at building materials retailers surged by more than 14%, while sellers of sporting goods, hobby supplies, games, and musical instruments enjoyed a healthy 7% jump.

Despite the drop in sales at restaurants, this also was not seen as a time to take up dieting. If people can’t eat out then those dollars will be spent eating in. The food and beverage store segment climbed nearly 12% in 2020 with beer, wine, and liquor stores’ portion up nearly 18%.

For the market as a whole, however, total sales were down, and a great number of retailers found their properties were no longer financially viable. Announced store closures exceeded 15,500 in 2020, according to Forbes, and a high concentration of those centered around fashion, including Gap (350 stores), Coldwater Creek (334 stores), Victoria’s Secret (250 stores), and Forever 21 (207 stores). Home stores, too, featured prominently among those chains needing to shutter some (or all) of their locations, such as Pier 1 Imports (936 stores), Tuesday Morning (230 stores), and Bed Bath & Beyond (200 stores). A good number of closures were also seen amongst department stores ranging from discounters to high end merchandisers, including JCPenney (175 stores), Macy’s (125 stores), Sears/K-Mart (124 stores), Lord & Taylor (30 stores), and Neiman Marcus (22 stores).

While many retailers have found these times quite trying, others have actually found opportunities and much of that is at the discount end of the market. Combined, Dollar General, Dollar Tree and Family Dollar have recently declared plans to open more than 1,600 new stores—over one third of all announced openings in 2021, according to Coresight Research and Retail Dive. Other low-priced retailers have also announced plans to expand, including Five Below (170 new stores) and TJX (120 new stores).

Scrambling to Keep the Lights On

With the sharp drop in in-store shopping brought on by the pandemic lock-down, many retailers looking to survive responded with new or expanded offerings of fulfillment—specifically online ordering with curb-side pickup. The convenience to consumers of this model has in turn moved it from being a necessary, short-term work around to an ongoing post-COVID expectation.

A recent survey done by Deloitte reported that the percent of shoppers saying they wanted to “get in and out as quickly as they can” jumped from 37% pre-COVID to 59% by the second quarter of 2020. This same study revealed a strong preference for a one-stop shopping destination for everyday essentials—particularly at neighborhood shopping centers and strip malls. Knowing their customers value this option, nearly two thirds of retailers currently offer, or plan to offer, buy online, pickup at store (BOPIS) service, according to the National Association of Retailers.

The integration of online shopping with brick and mortar goes well beyond dedicating a few parking spaces to local pickup, however. Retailers are increasingly engaging in “omni-channel” marketing through all touch points, including real world (stores), digital (websites, email, social media) and more (customer support by phone) to build a personalized connection with their customers. Aligning all these facilities then leads to deepening their brand identity in the mind of consumers. And this is not just the domain of large, national retailers. Small Mom and Pop operations are increasingly connecting through Facebook and offering personalized promotions to maintain that unique relationship with their clients.

The upswing in shop-in-shop agreements further highlights how vendors large and small are adapting to the changing environment. The concept is not new but with slumping visitorship, big-box retailers and department stores are making the most of existing facilities by effectively sub-leasing a portion of their floor space to smaller, specialty vendors. Sephora recently penned a deal allowing the beauty products company to install 850 mini-stores within Kohl’s sites around the country. Similarly, Target will serve as a host for both Apple and Ulta Beauty. Meanwhile, Tonal, seller of high-tech fitness equipment will be going into 50 Nordstrom stores. These symbiotic relationships are a win-win for both partners. Faster, cheaper and easier than outfitting a full standalone store, smaller enterprises find this a great option for quickly setting up operations in an established location. For the host, choosing to partner with a complementary retailer brings added foot traffic while increasing revenue per square foot.