- Navigator

- Expansion Solutions

- Arts, Entertainment & Recreation

- Industry Analytics

Previously published in Expansion Solutions Magazine: https://www.expansionsolutionsmagazine.com/outdoor-recreation-good-economy/

Whether we are sports and recreation enthusiasts or casual recreators, we all have spent time and resources recreating in the outdoors. From hiking, walking, biking, exploring, to boating, skiing and climbing there are more opportunities across the U.S. in every community, region and state for residents and visitors. In this article, we will explore outdoor recreation from the eyes of an economic and business developer examining trends, economic impacts, and examples of approaches for integrating into economic strategies and actions.

From an economic standpoint, outdoor recreation is a mix of primary activities, goods and services such as parks and attractions and sporting goods plus related manufacturing, wholesale and retail. This includes:

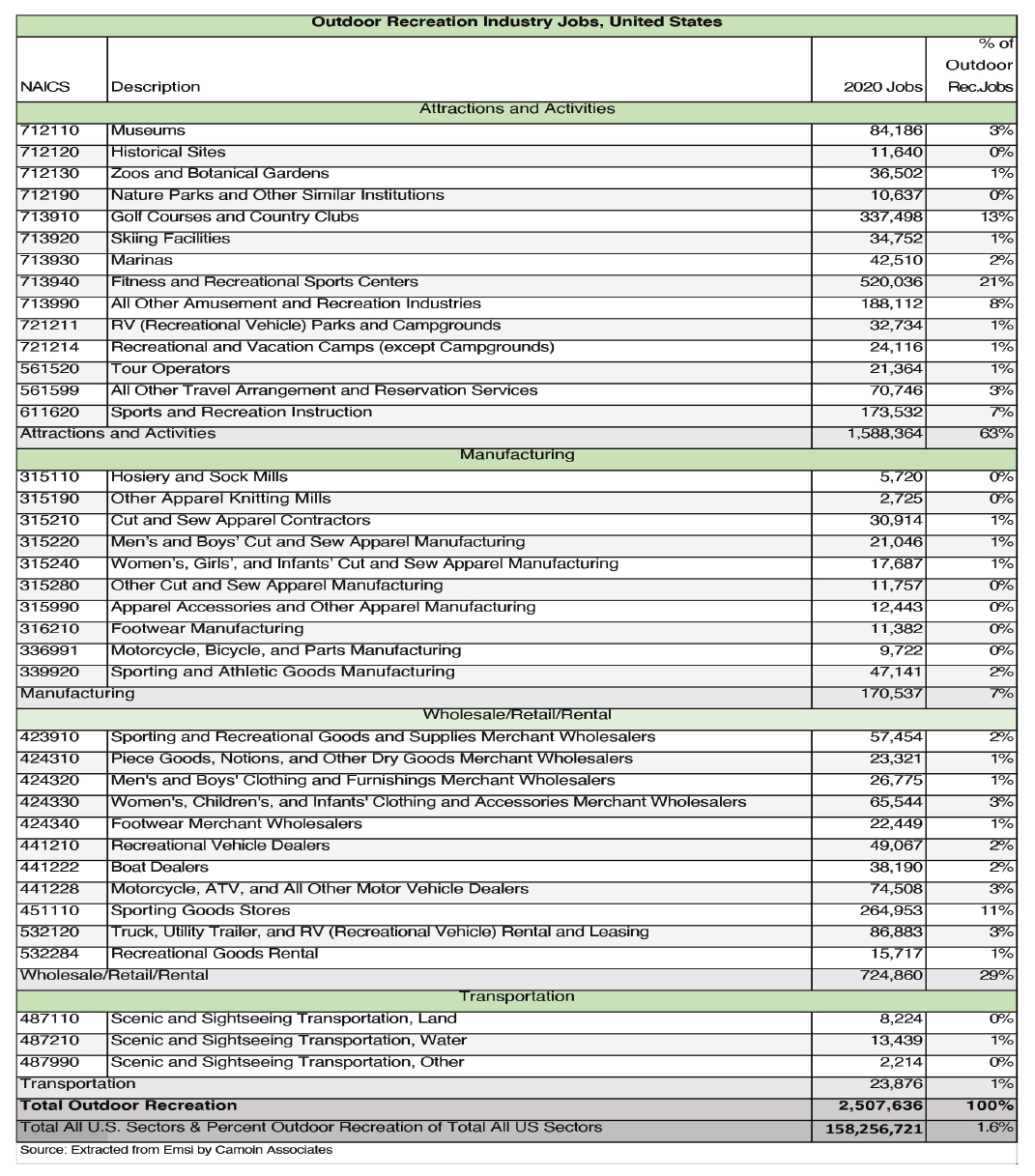

- Attractions and Activities: Museums, historical sites, zoos and botanical gardens, nature parks, golf courses and country clubs, skiing facilities, marinas, fitness and recreational sports centers, RV (recreational vehicle) parks and campgrounds, recreational and vacation camps (except campgrounds), tour operators, sports and recreation instruction

- Manufacturing: Sporting and recreation equipment, supplies and apparel

- Wholesale/Retail/Rental: Including sporting goods, clothing and footwear, vehicles and boats

- Transportation: Including scenic and sightseeing transportation

A detailed list of sectors and subsectors is included at the end of this article.

Economic Trends

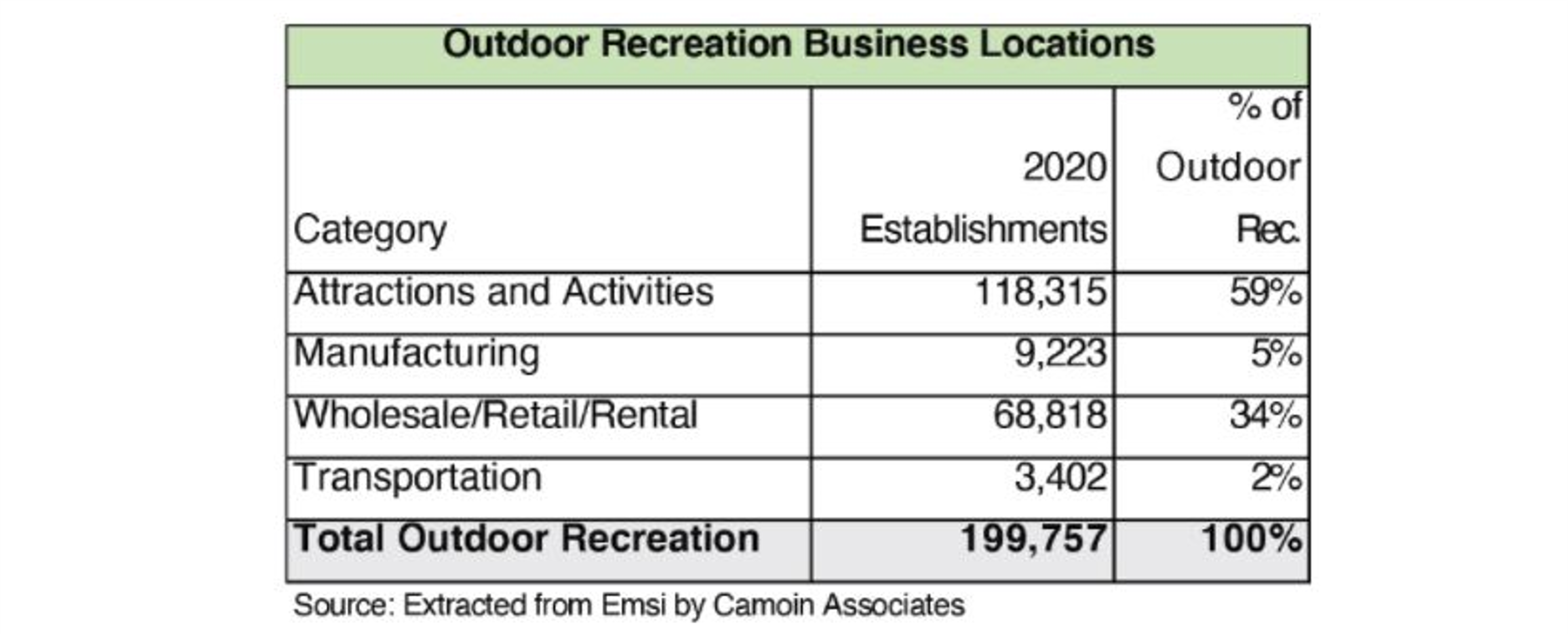

In 2020, there were an estimated 200,000 businesses directly or indirectly related to outdoor recreation in the U.S. – the largest category being business that are or provide attraction and activities with an estimated 118,315 establishments.

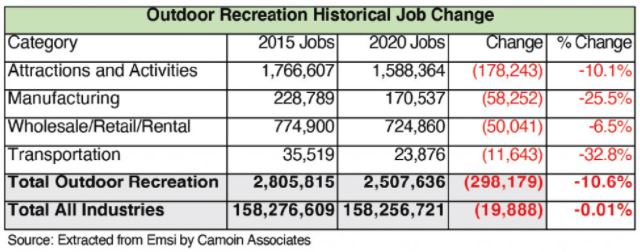

In terms of jobs, there were an estimated 2.5 million employees in 2020 within outdoor recreation or related industries with attractions and activities accounting for the largest share with an estimated 1.6 million employees. Like many industries employment took a hit during the COVID-driven recession shedding nearly 300,000 jobs from 2015 levels or an 11 percent decrease. And while being outdoors was on the rise during COVID, due to safety shutdowns and overall economic decline, business activity in the outdoors was highly impacted.

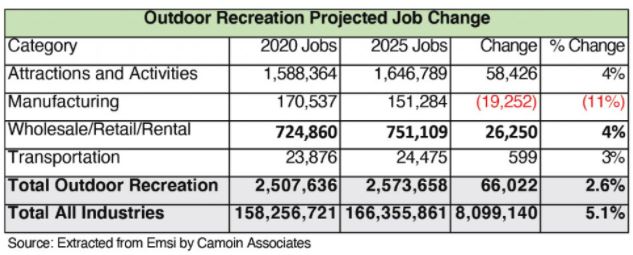

Like the economy overall, outdoor recreation employment is expected to grow employment with an estimated increase of 2.6 percent through 2025.

What are factors that are driving some of the trends in outdoor recreation and related industries? Like all industries, outdoor recreation and related industries have been highly impacted by COVID-19. While many people increased their level of being and recreating outside as indoor activities shutdown or were limited for safety, business in the industries have been negatively impacted. Those that make products such as bicycles have been highly impacted by supply chain disruptions and cost of inputs. Furthermore, those that sell through brick-and -mortar retail locations have seen trends move towards more on-line purchases which began prior to COVID but has since accelerated due COVID. Those that rely on high levels of in-person demand for events and activities are impacted by lack of demand due to safety concerns and limitations.

Positive signs for the industry are resulting from an increased awareness of the benefits to individual and community health of being and recreating outdoors. This will have a positive influence on demand in the next five years as will an increase in disposable income as more workers across the economy are able to go back to work. Also, with an increase in remote work, employees will continue to seek outdoor recreation activities within their community and nearby region and have additional time due to shorter commutes. Additionally, foreign travel has been limited and will likely continue to be so with increased day-tripping or traveling domestically within the U.S. also driving demand. For retailers and manufacturers, the trend of integrating retail with outdoor experiences will likely continue to provide opportunities.

Why Outdoor Recreation is Important to Economic Development: Understanding Economic Impact

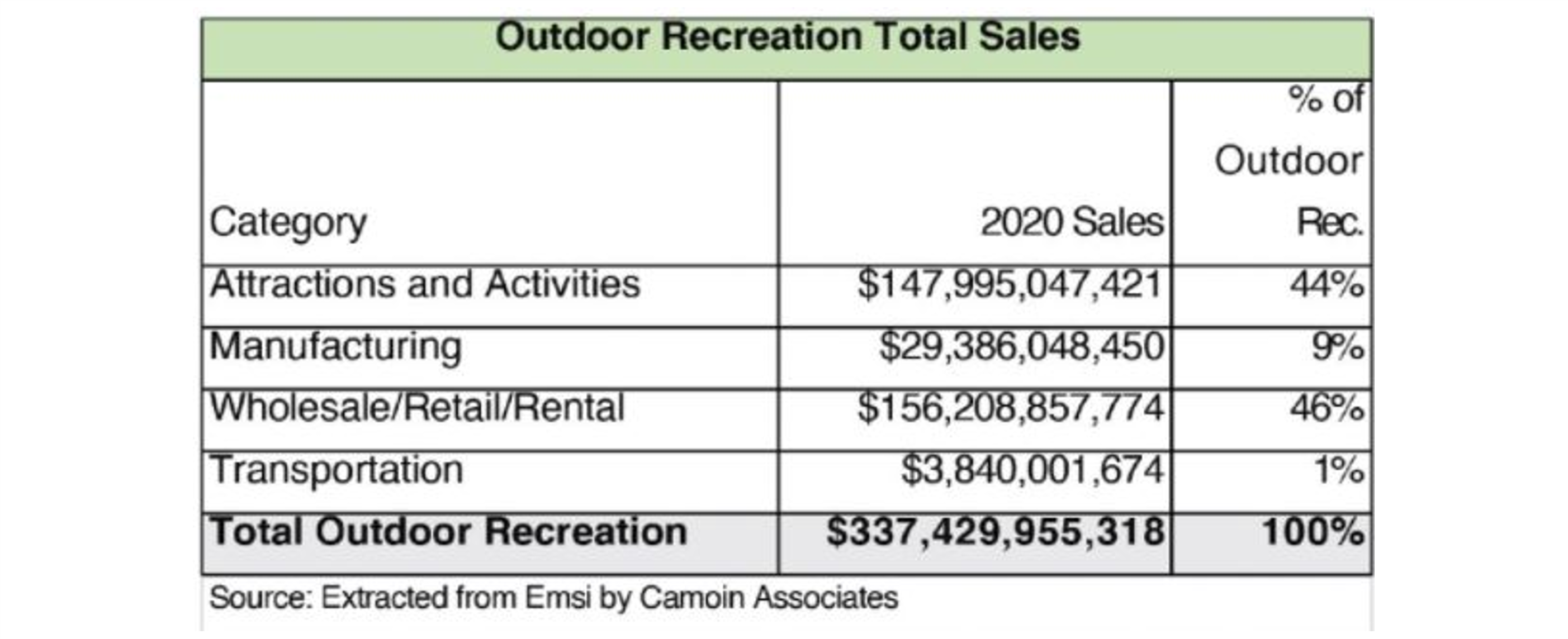

In 2020, sales within outdoor recreation and related industries were estimated at $337 billion in the U.S. with attractions and activities accounting for 44 percent of sales and related wholesale, retail and rental accounting for 46 percent.

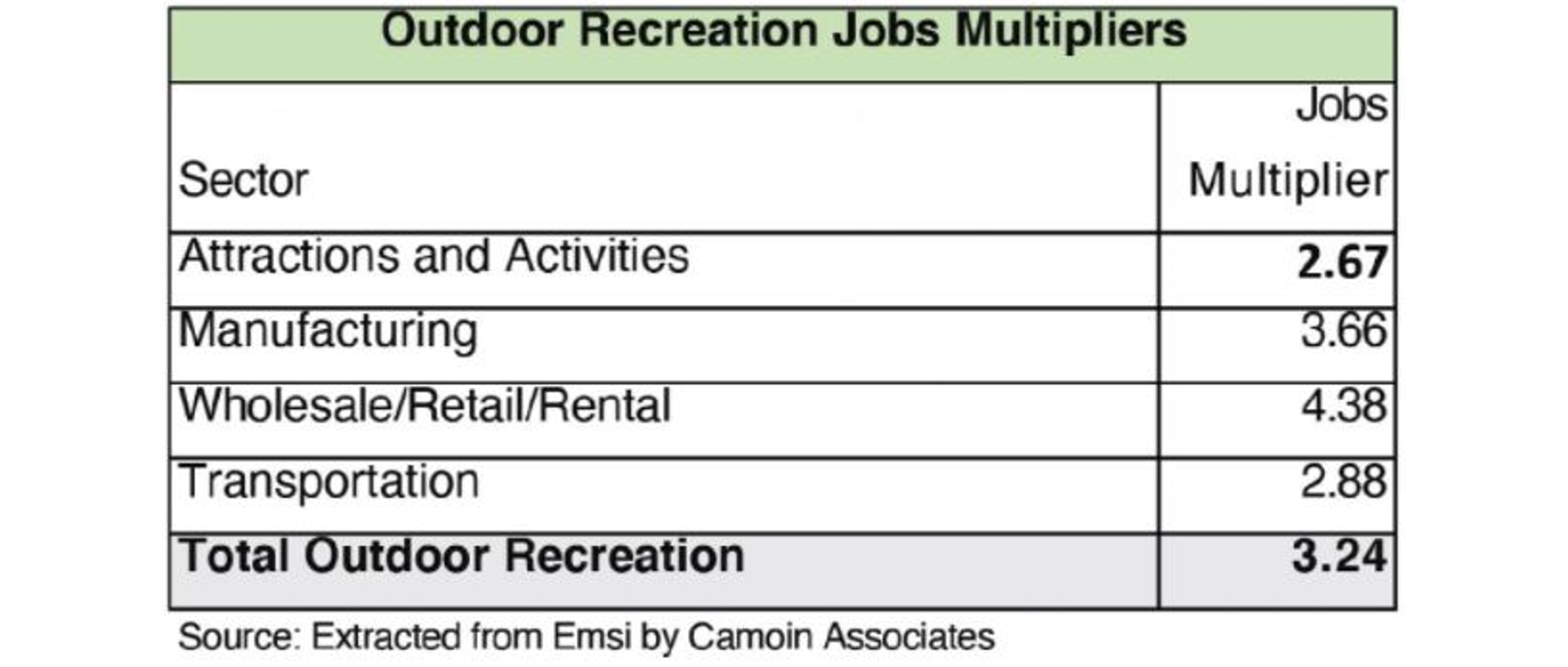

The impact of outdoor recreation extends beyond its direct employment and sales levels. It has a positive impact on the demand across many industries including tourism, manufacturing, services, retail, food and accommodations. The more that people get outside and visit outdoor recreation areas and venues, the more that gets spent on these economic goods and services. Beyond the direct impact of these sales, the dollars also create indirect economic benefits. On average, every direct job in outdoor recreation and related industries results in the creation of a total of 3.24 jobs in the economy.

Also, with the popularity of outdoor recreation on the rise, those areas with quality and accessible recreation assets such as parks, trails, lakes and beaches increase the attractiveness to workers and therefore businesses. Finally, outdoor recreation increases individual and community health, and both are tied to economic opportunity and prosperity.

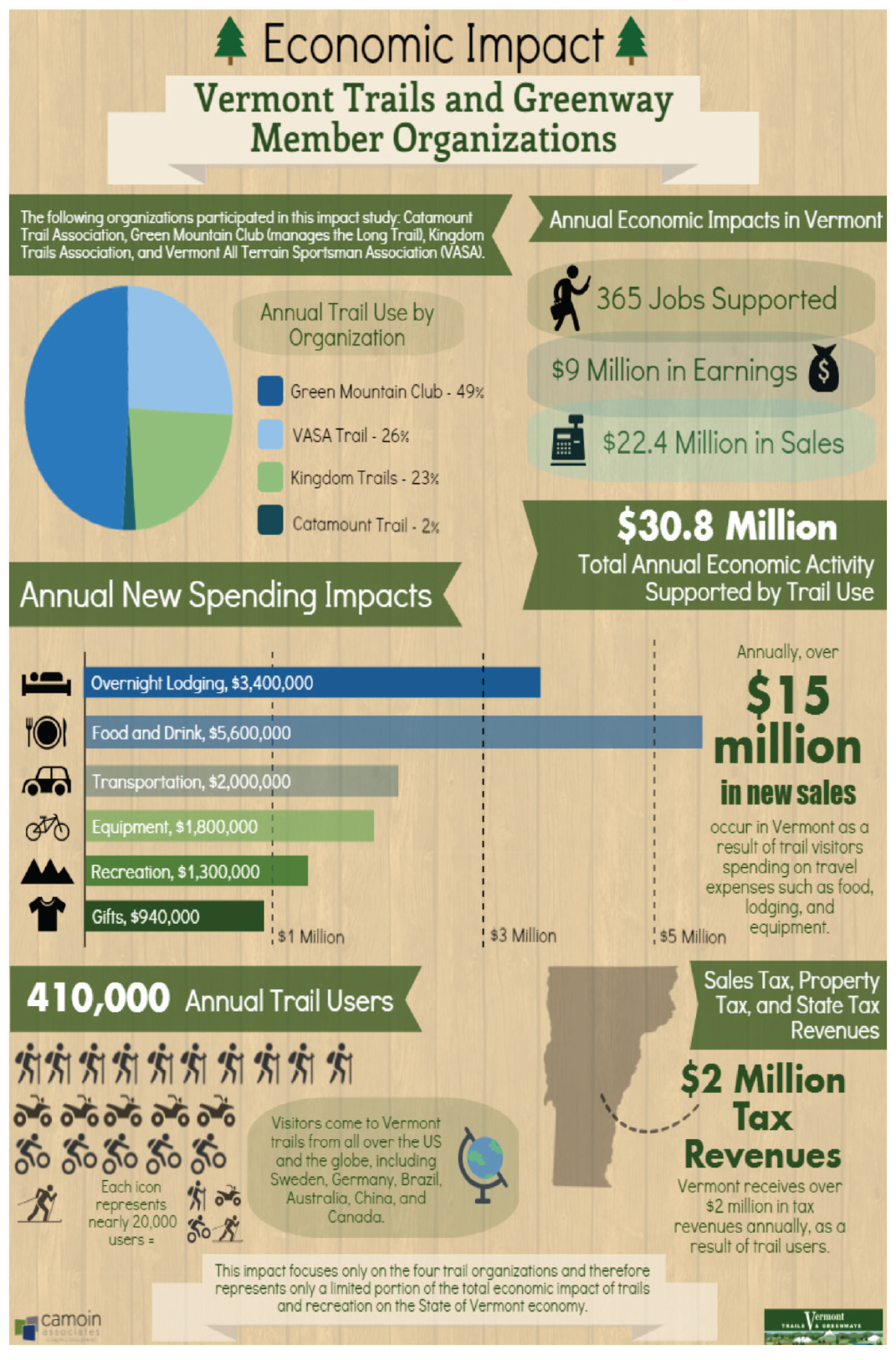

Case Example: Economic Impact of Outdoor Recreation in Vermont

The Vermont Trails and Greenways Council is an organization of volunteers dedicated to trail preservation, promotion, and development in Vermont. In late 2015, the Council commissioned Camoin Associates to complete an economic impact study to convey and quantify the economic presence that organized trail-based recreation contributes to the Vermont economy. The analysis included a trailhead survey, estimate of total trail usage, and impact modeling to quantify the impact of the Council’s trail system on Vermont in terms of jobs, earnings, and sales. The final document was used to demonstrate the positive impact of outdoor recreation on Vermont’s economy. The analysis documented that use of trails supported $30.8 million in economic activity and $2 million in tax revenues.

Integrating Outdoor Recreation into Economic and Business Development Strategies and Actions

Outdoor recreation is often overlooked in economic and business development in favor of focuses on technology and innovation-intensive industries which are seen as having higher wages and export potential. While these may be true, it also ignores the fact that economic and business development is holistic and success requires multiple opportunities and choices each supporting one another. As mentioned above, outdoor recreation generates jobs and sales which further create economic opportunity, create an environment desired by workers and support individual and community heath. In both rural and urban areas, as well as areas in-between, outdoor recreation can and should be part of strategies for economic well-being.

Case Example: State of Maine

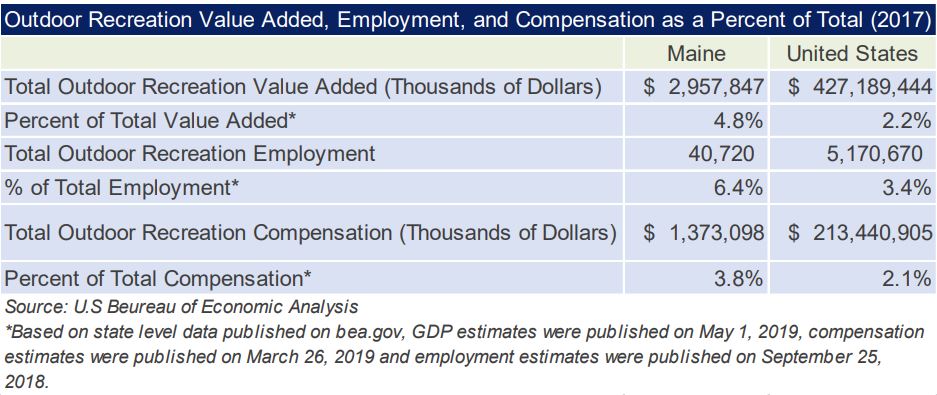

Maine is a state well-known for its outdoor recreation areas from the coastal beaches and marshes to lakes and rivers, to its forest and mountains with signature assets including Acadia National Park, the Appalachian Trail, Baxter State Park, the eastern Trail, ski mountains, acres of wilderness and more. Every region in Maine benefits economically from some form of outdoor recreation and most from multiple opportunities. Understanding this, the state, regions and localities all seek to integrate outdoor recreation into economic and business development.

At the state level, the outdoor recreation economy is supported by the Maine Office for Economic and Community Development (Maine DECD) and the Office of Tourism which focuses on marketing for domestic and foreign travel, as well as day visitors. It includes the Office of Outdoor Recreation, www.maine.gov/decd/programs/maine-office-of-outdoor-recreation, created in 2018 to leverage Maine’s assets and outdoor recreation heritage to grow the economy and build Maine’s outdoor recreation brand. But support for outdoor recreation at the state level in Maine does not stop at the Office of Tourism. Through its Domestic Trade Program, www.maine.gov/decd/domestic-trade, the Maine DECD provides market analytics and business support to increase domestic trade and includes in its work a focus on outdoor recreation manufacturing. A market profile completed for Maine DECD on outdoor recreation manufacturing can be found at: www.maine.gov/decd/sites/maine.gov.decd/files/inline-files/Final%20Market%20Profile%20-%20Outdoor%20Recreation%20-%20Domestic%20Trade%20Basline%20Study%20-%20State%20of%20Maine%20DECD.pdf. That profile documented the significance of outdoor recreation to Maine’s economy and found that outdoor recreation in Maine represented 4.8 percent of total value added for all sectors compared to 2.2 percent nationally.

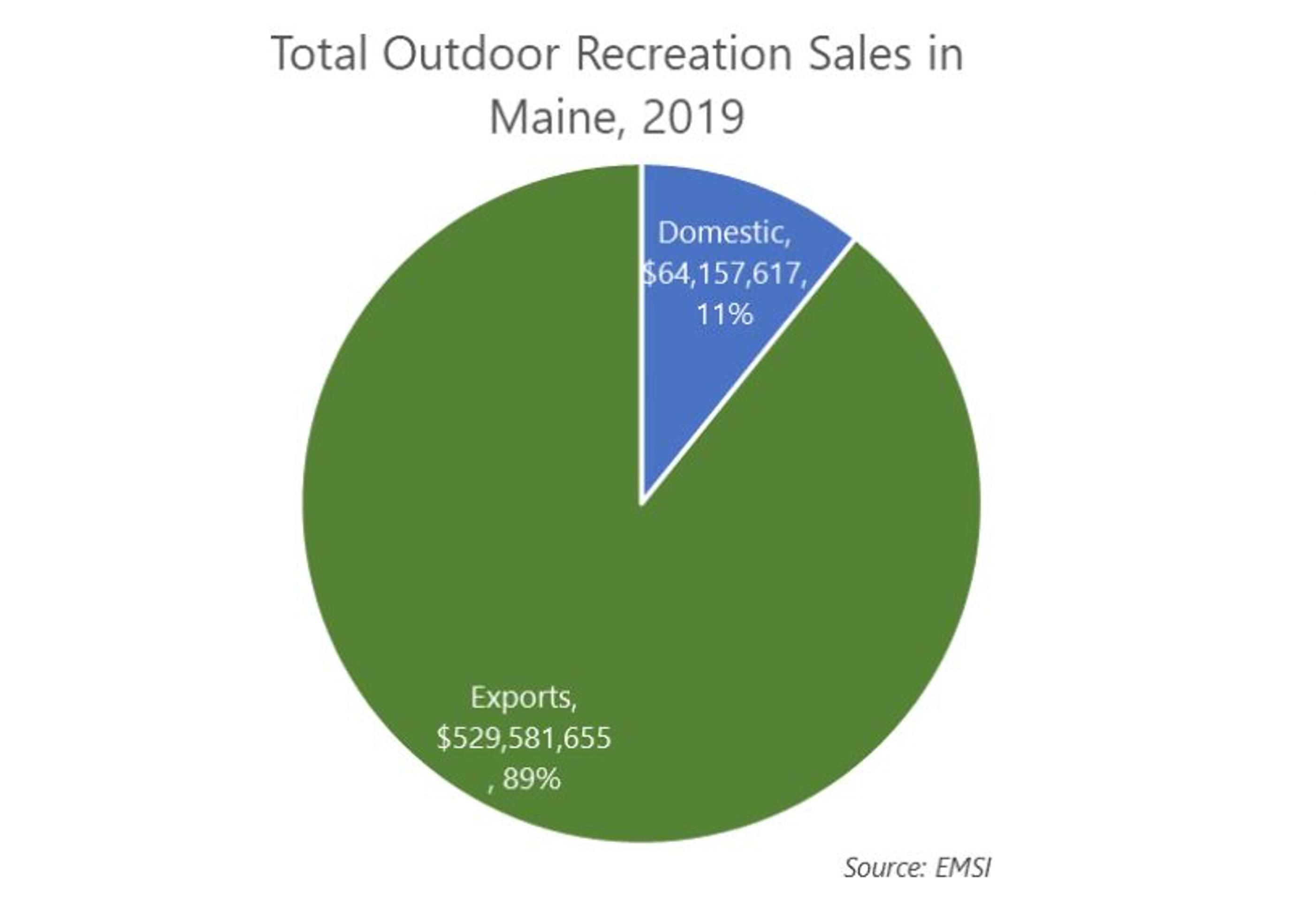

And 2019, sales in Outdoor Recreation Manufacturing in Maine totaled $539.7 million of which an estimated $64.2 million (11 percent) were domestic sales (made to entities in Maine) and $529.6 million (89 percent) were exports (made to entities outside of Maine).

The market data combined with technical assistance helps the state, its regions, localities and industry groups to continue a focus on outdoor recreation to support economic opportunity.

At the regional level in Maine, the Southern Maine Planning and Development Commission is conducting analysis of the outdoor recreation economy throughout its three-county region. Specifically, it is assessing trends in employment and business activity, connections between the economic activity and the outdoor assets such as trails and parks and measuring the impact of outdoor recreation on the regional economy. Results will be used to develop strategies and actions to further support maintenance of outdoor assets and infrastructure and further support business development.

Locally, the Town of Skowhegan is taking a unique approach to outdoor recreation that includes it as a focus area along with its connection to the community’s downtown through its Main Street Program, https://mainstreetskowhegan.org/, and its historical and growing food industry. The three together are targeted on supporting local business and entrepreneurship. To assist the Town and its business the Town conducted a detailed market analysis of opportunities for within outdoor recreation and food related industries, https://mainstreetskowhegan.org/industry-market-analysis/. That analysis found:

“Within a large region rich with natural resources, Skowhegan is the prime location for entrepreneurs, residents, and small businesses to leverage regional economic activity within the recreation sector. This is thanks to its location on the Kennebec River and its role as a civic, service, and commerce center equipped with core infrastructure (i.e., active downtown, broadband, existing businesses, etc.). In addition, the municipality’s proposed whitewater paddle and surf park, which will be located in the downtown river gorge, will drive opportunity in the recreation market. This makes Skowhegan well suited for accommodating growth in the recreation sector, specifically:

- Businesses that offer outdoor recreation activities (sightseeing, tour operators, RV parks and campgrounds, etc.).

- Sporting and recreational good retailers and wholesalers that offer products for outdoor activities; and

- Manufacturers of outdoor sporting and recreational goods (camping, kayaking, skiing, ATV, hiking, etc.).

The combined focus at the state, local and regional levels backed by data-driven strategies and programs is helping Maine support and grow its outdoor recreation economy.

Conclusion

Outdoor recreation offers economic opportunities for states, regions, and communities for business, community, and workforce development. Though like most industries outdoor recreation has been impacted by COVID-19, it has seen growth in interest as people seek and demands greater access and use of the outdoors for health, safety, and personal enjoyment. This will drive economic trends over the next five years. Through strategies that are driven by data and market intelligence, economic developers can integrate outdoor recreation into their overall economic development programs to leverage these opportunities. Doing so requires looking beyond outdoor recreation as a leisure activity or as its own narrow sector and considering its connections and importance the larger economic ecosystem.